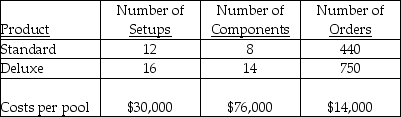

Stanley Corp. manufactures two models of its roasting pans, a standard and a deluxe model. Three activities have been identified as cost drivers and the related costs pooled together to arrive at the following information:

-If activity-based costing is used, then the total amount of overhead allocated to the deluxe model would be

Definitions:

Percentage-Of-Completion

An accounting method that recognizes revenues and gross profit on long-term contracts in proportion to the work completed to date.

Gross Profit

The difference between sales revenue and the cost of goods sold, representing the basic profitability of the sales of goods and services.

Construction Costs

Expenses incurred during the process of building structures, infrastructure, or other significant physical assets, including materials, labor, and overhead.

Service Cost

The expense recognized by an employer for the portion of an employee's pension or post-retirement plan earned during the year.

Q9: Transfer-pricing systems do NOT exist to<br>A) communicate

Q30: The total fixed cost is<br>A) $39,250.<br>B) $17,816.<br>C)

Q32: Costs are allocated for all the following

Q68: If the overhead control account has a

Q76: Residual income for the Toro division is<br>A)

Q82: Profit centres can exist only in a

Q84: The ending inventory under absorption costing would

Q92: Which of the following personnel should be

Q97: The costing method, which excludes fixed manufacturing

Q123: Which of the following is NOT an