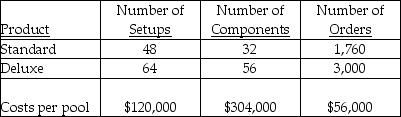

Dorpinghaus Corp. manufactures two models of its telephones, a standard and a deluxe model. Three activities have been identified as cost drivers and the related costs pooled together to arrive at the following information:

-If activity-based costing is used, then the total amount of overhead allocated to the standard model would be

Definitions:

Depletion Expense

The allocation of the cost of natural resources, such as minerals or timber, over their productive life to reflect their consumption.

Tons

A measurement unit of weight equal to 2,000 pounds in the United States (short ton) or 2,240 pounds in the UK (long ton).

Straight-Line Method

A depreciation technique that allocates an equal portion of an asset’s cost to each year of its useful life.

Residual Value

The estimated value of a fixed asset at the end of its useful life, reflecting what it could be sold for or its disposal cost.

Q11: Van Sickle Corporation has a joint process

Q31: Currently, the contribution approach cost of manufacturing

Q44: Activity-based accounting systems<br>A) accumulate overhead costs by

Q57: If the direct method is used to

Q65: Which symbol in the mixed-cost function, Y

Q76: Residual income for the Toro division is<br>A)

Q78: The independent variable (activity) selected should have

Q78: The techniques used to determine the cost

Q81: Which of the following is NOT a

Q87: Any action taken in conflict with organizational