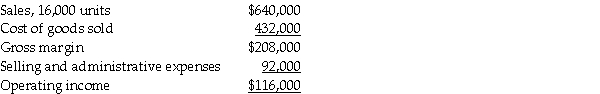

Johnson Corp. prepared the following absorption-costing income statement for the year ended May 31, 20X1.  Additional information follows:

Additional information follows:

Selling and administrative expenses include $3 of variable cost per unit sold. There was no beginning inventory, and 17,500 units were produced. Variable manufacturing costs were $22 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required: Prepare a variable costing income statement for the same period.

Definitions:

Genetic Engineering

The manipulation of an organism's genes using biotechnology, including the editing, adding, or removing of DNA sequences to achieve desired traits.

Displacement

A psychological defense mechanism where mind redirects emotions or feelings from the original source to a less threatening target.

Concepts

Abstract ideas or general notions that represent categories or classes of objects, events, or activities.

Language Acquisition Device

A hypothetical module of the human mind proposed by Noam Chomsky to account for the innate predisposition for language acquisition.

Q9: Absorption costing classifies costs as either product

Q21: Gross margin is the same as contribution

Q26: If targeted after-tax net income is $27,000

Q34: Conquest Industries made the following observations of

Q62: The key difference between the FIFO and

Q71: If Division X is NOT at full

Q87: The labour rate variance is<br>A) $5,250 favourable.<br>B)

Q100: Which of the following would probably NOT

Q100: Decentralization is most successful when<br>A) segment autonomy

Q127: The operating income (loss) under absorption costing