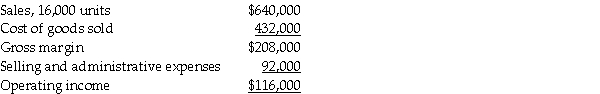

Johnson Corp. prepared the following absorption-costing income statement for the year ended May 31, 20X1.  Additional information follows:

Additional information follows:

Selling and administrative expenses include $3 of variable cost per unit sold. There was no beginning inventory, and 17,500 units were produced. Variable manufacturing costs were $22 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required: Prepare a variable costing income statement for the same period.

Definitions:

Ruff Degradation

A chemical reaction used to shorten the carbon chain of sugars by one carbon atom through oxidation.

Optically Active

Describes compounds that have the ability to rotate the plane of polarized light, a property often associated with the presence of chiral centers.

Aldaric Acid

A variety of sugar acid derived by converting the aldehyde group and the primary alcohol group in an aldose into carboxylic acids through oxidation.

Soyasaponin

A class of organic compounds found in soybeans, known for their foaming properties and potential health benefits.

Q16: The manner in which the activities of

Q22: Activity-based accounting systems classify more costs as

Q25: The FIFO process-costing method sharply distinguishes the

Q35: Strategic decisions about the scale and scope

Q46: What is Philips' 20X3 productivity measure in

Q54: The way in which the activities of

Q88: The cost of producing one unit of

Q98: Which statement would NOT be a possible

Q109: Farmers Corporation purchased $170,000 of direct materials

Q122: Factory overhead includes<br>A) direct materials and direct