Bowzer Industries began operations on January 1, 2006. The company sells a single product for $10 per unit. During 2006, 60,000 units were produced and 50,000 units were sold. There was no work in process inventory at December 31, 2006.

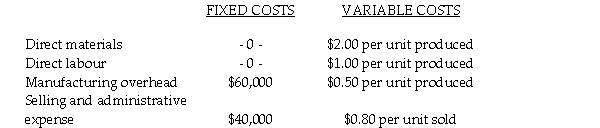

Bowzer uses an actual cost system for product costing and actual costs for 1998 were as follows:  a. What is the product cost per unit under:

a. What is the product cost per unit under:

(i) variable costing

(ii) absorption costing

b. What is the finished goods inventory cost at December 31, 2006 under:

(i) variable costing

(ii) absorption costing

c. Prepare income statements for 2006 under:

(i) variable costing

(ii) absorption costing

d. Reconcile the difference between variable costing income and absorption costing income.

Definitions:

Crash Cost

The additional costs associated with rushing or compressing a project schedule to complete it in the shortest time possible.

CPM Network

Critical Path Method Network, a project management tool that helps in determining the longest path of planned tasks to the end of a project.

Normal Time

The average observed time, adjusted for pace.

Normal Cost

The standard expenses incurred during the production of goods or services, including direct labor, materials, and overhead costs.

Q18: Indicate whether each of the following costs

Q25: The journal entry to record the application

Q27: Compare financial and nonfinancial performance, and explain

Q35: Identify which of the statements below is

Q36: What is Conway's 20X3 productivity measure in

Q55: The application of cost measures to expected

Q59: If the tax rate is 40 percent,

Q72: The income percentage of revenue is<br>A) 100

Q80: Assuming the physical-units method of allocating joint

Q81: If the firm wants to earn $70,000