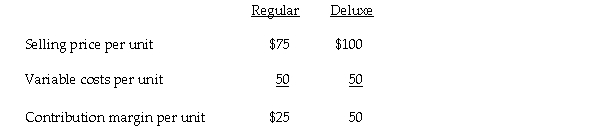

The Orton Company produces two types of food processors. Information about the two products for 2006 is as follows:  The company expects fixed costs to be $150,000 in 2006. The firm expects 80% of its sales (in units) to be Regular model food processors.

The company expects fixed costs to be $150,000 in 2006. The firm expects 80% of its sales (in units) to be Regular model food processors.

a. Determine the break-even point in units.

b. Determine sales in units of Regular and Deluxe models necessary to generate a before-tax profit of $90,000.

c. Determine sales in units of Regular and Deluxe models necessary to generate an after-tax profit of $90,000 if the tax rate is 40 percent.

Definitions:

Father-Stepmother Family

A family structure where a child is raised by their biological father and a stepmother.

Previous Marriage

A marriage that one or both individuals were involved in before their current relationship.

Nuclear Family Myth

The belief that the nuclear family, consisting of a mother, father, and their children, is the most natural and best unit for societal and individual well-being, even though many societies and cultures embrace diverse family structures.

Remarried Family

A family structure formed when one or both partners in a marriage have been previously married and may involve stepchildren.

Q7: Transfer prices are the amounts charged by

Q24: The contribution by segment is<br>A) $25,000.<br>B) $37,500.<br>C)

Q27: The cost of producing one unit of

Q51: If the sales price per unit is

Q53: The total purchases budgeted for March should

Q76: Two common methods for comparing alternatives are

Q79: The applied factory overhead cost in Case

Q96: What is the net income for 10,000

Q100: Which of the following would probably NOT

Q103: The net present value model expresses all