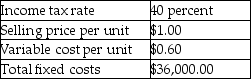

Hampton Company, a producer of computer disks, has the following information:

-How many units must be sold to obtain a targeted after-tax income of $6,000?

Definitions:

Variable Overhead Efficiency Variance

The difference between actual and budgeted variable overhead costs, attributable to differences in productive efficiency.

Favorable

A term used in finance and accounting to describe a situation or variance that is better than expected or budgeted, often indicating profits or gains.

Labor Efficiency Variance

The difference between the actual labor hours used to produce a good or service and the standard labor hours expected to be used, measuring labor efficiency.

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the expected (or standard) variable overhead based on activity levels.

Q8: A cost that changes in direct proportion

Q18: Costs that contain elements of both fixed

Q18: The capital turnover is<br>A) 2.<br>B) 5.<br>C) 10.<br>D)

Q23: Multinational companies use transfer prices to minimize

Q50: Bombast Industries identified the following budgeted overhead

Q66: The book value of the machine as

Q78: Residual income is defined as<br>A) net income

Q91: If Department C uses machine hours to

Q100: Accounting is an example of a producing

Q116: If the step-down method of allocating costs