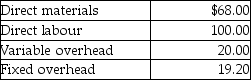

The Ink and Paper Divisions are part of the same company. Currently the Paper Division buys a part ingredient from Ink for $192. The Ink Division wants to increase the price of the part it sells to Paper by $48 to $240. The manager of Paper has stated that it cannot afford to go that high, as it will decrease the division's profit to near zero. Paper can buy the part from an outside supplier for $224. The cost data for the Ink Division is as follows:

If Ink ceases to produce the parts for Paper, it will be able to avoid one-third of the fixed manufacturing overhead. The Ink Division has excess capacity but no alternative uses for its facilities.

If Ink ceases to produce the parts for Paper, it will be able to avoid one-third of the fixed manufacturing overhead. The Ink Division has excess capacity but no alternative uses for its facilities.

-What is the maximum transfer price that should be charged?

Definitions:

Past Earnings

The historical profits or net income that a company has generated over a specific period, often used as an indicator of financial health and operational success.

Future Earnings

The projected income a company or individual is expected to generate over a future period.

Intangible Assets

Assets that lack physical substance but have value, such as intellectual property, brand reputation, and copyrights.

Goodwill

An intangible asset representing the value of a company's brand, customer relationships, and other non-physical assets.

Q5: If the step-down method of allocating costs

Q19: Mathematical models of the master budget that

Q46: The accounting rate of return based on

Q54: In the mixed-cost function, Y = F

Q54: The way in which the activities of

Q60: All of the following are categories of

Q69: Which of the following definitions of invested

Q73: The annual after-tax operation costs would be<br>A)

Q78: In the contribution approach, all factory overhead

Q90: The following information was compiled by Bovinnette