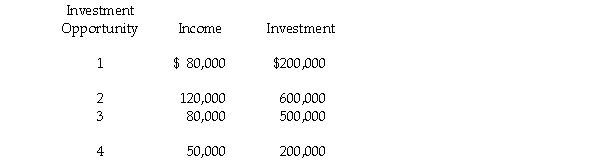

Raymer Incorporated has just formed a new division and the following four investment opportunities are available to the division. The firm requires a minimum return of 20 percent.  a. If you were the division manager and your evaluation was based on ROI, which investment opportunities would you accept?

a. If you were the division manager and your evaluation was based on ROI, which investment opportunities would you accept?

b. If your evaluation was based on RI, which investment opportunities would you accept?

c. If you were president, which projects would you want the division to accept and which performance measure would you use to encourage this action?

Definitions:

Interpersonal Therapeutic Groups

Therapy groups focused on the development and improvement of interpersonal relationships within the group setting, often used to address personal issues.

Here and Now

A focus on the present moment, often emphasizing awareness and mindfulness in the current situation.

External

Pertaining to or existing outside of the mind or an individual, originating from or situated in the external environment.

Process Debriefing Groups

A method used in psychology and organizational training where participants reflect on a completed task or process, focusing on what happened, why it happened, and how to improve in the future.

Q4: Underapplied overhead is always the difference between

Q4: The fixed costs required to achieve a

Q8: A cost that changes in direct proportion

Q20: What is the present value of the

Q24: _ are sometimes called rolling budgets.<br>A) Strategic

Q37: The approximate internal rate of return of

Q40: The residual income is<br>A) $200,000.<br>B) $120,000.<br>C) $

Q73: What is Connors' 20X5 productivity measure in

Q85: Assume straight-line amortization in all computations, and

Q90: Another term for market interest rate is<br>A)