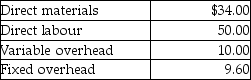

The Pen and Pencil Divisions are part of the same company. Currently the Pencil Division buys a part ingredient from Pen for $96. The Pen Division wants to increase the price of the part it sells to Pencil by $24 to $120. The manager of Pencil has stated that it cannot afford to go that high, as it will decrease the division's profit to near zero. Pencil can buy the part from an outside supplier for $112. The cost data for the Pen Division is as follows:

If Pen ceases to produce the parts for Pencil, it will be able to avoid one-third of the fixed manufacturing overhead. The Pen Division has excess capacity but no alternative uses for its facilities.

If Pen ceases to produce the parts for Pencil, it will be able to avoid one-third of the fixed manufacturing overhead. The Pen Division has excess capacity but no alternative uses for its facilities.

-From the standpoint of the company as a whole, should Pencil continue to buy from Pen or start to buy from the outside supplier?

Definitions:

Holding Cost

The expenses associated with storing inventory that is not yet sold or utilized, including storage, insurance, and obsolescence costs.

Annual Demand

The total quantity of a product or service that is demanded over the course of a year.

Salvage Value

The estimated resale value of an asset at the end of its useful life.

Service Level

A measure of performance that represents the percentage of customer demands that are met without delay.

Q7: A management control system must evolve with

Q11: Quoted market interest rate that includes an

Q33: A cost function<br>A) need not have a

Q34: The Chevette Company has come to you

Q40: Capital expenditure models that identify criteria for

Q64: A method of allocating support department costs

Q76: Actual factory overhead cost in Case X

Q90: The amount of fixed maintenance costs allocated

Q91: The master budget includes forecasts for all

Q112: If the step-down method of allocating costs