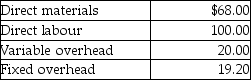

The Ink and Paper Divisions are part of the same company. Currently the Paper Division buys a part ingredient from Ink for $192. The Ink Division wants to increase the price of the part it sells to Paper by $48 to $240. The manager of Paper has stated that it cannot afford to go that high, as it will decrease the division's profit to near zero. Paper can buy the part from an outside supplier for $224. The cost data for the Ink Division is as follows:

If Ink ceases to produce the parts for Paper, it will be able to avoid one-third of the fixed manufacturing overhead. The Ink Division has excess capacity but no alternative uses for its facilities.

If Ink ceases to produce the parts for Paper, it will be able to avoid one-third of the fixed manufacturing overhead. The Ink Division has excess capacity but no alternative uses for its facilities.

-According to agency theory, employment contracts will trade off the following three factors:

Definitions:

Cash Payback Period

The duration it takes for the earnings from an investment to cover the initial amount invested.

Annual Net Cash Flows

The total amount of money, including inflows minus outflows, that a business generates over one year.

Expected Total Cash Flows

The projection of all the cash that is anticipated to be received or paid out over a certain period of time in the future.

Cash Payback Period

The time period required for the returns from an investment to repay the initial capital outlay.

Q7: The present value of 5-year annuity of

Q10: The cash inflow effect of a disposal

Q13: Which of the following is NOT an

Q23: Multinational companies use transfer prices to minimize

Q30: The process of altering certain key variables

Q54: One conventional way of allocating joint costs

Q54: The way in which the activities of

Q57: Explain the difference between committed fixed costs

Q99: Projects that, if accepted, preclude the acceptance

Q106: Which of the following is NOT a