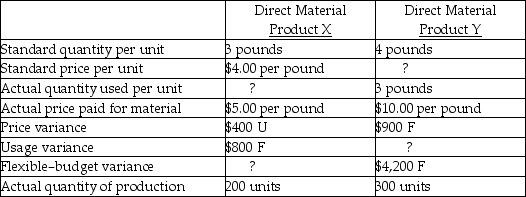

The following data apply to Walker Corporation for the year 20X4.

-For Product X, the total actual quantity used was

Definitions:

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditures to the correct period.

Depreciation Expense

A technique for spreading out the expense of a physical asset throughout its lifespan.

Fixed Asset

Long-term tangible assets held for business use and not expected to be converted to cash in the upcoming fiscal year, such as buildings, machinery, and equipment.

Accrued Expense

Expenses incurred but not yet paid or recorded at the end of an accounting period, recognizing expenses when they are incurred, not when they are paid.

Q2: A statement of planned cash receipts and

Q7: The total cash received in June on

Q16: The cost of assets is recognized by

Q23: Multinational companies use transfer prices to minimize

Q27: Consider the sine of any angle between

Q38: Which expression is dimensionally consistent with an

Q40: The residual income is<br>A) $200,000.<br>B) $120,000.<br>C) $

Q58: A sacrifice or giving up of resources

Q68: Service organizations<br>A) sell tangible goods.<br>B) are not

Q87: The labour rate variance is<br>A) $5,250 favourable.<br>B)