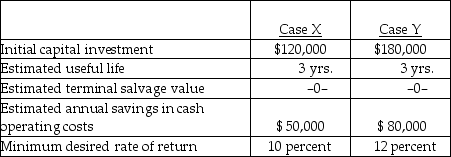

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

-The payback period in case X is

Definitions:

Manufacturing Margin

Similar to contribution margin but specifically related to manufacturing, it evaluates the difference between manufacturing costs and the sales price of goods.

Contribution Margin

The amount by which a product's selling price exceeds its total variable costs, indicating the contribution towards covering fixed costs.

Operating Income

Earnings from a company's primary business activities, excluding costs and expenses, interest, and taxes.

Absorption Costing

An approach to accounting that integrates all costs associated with manufacturing - including direct materials, direct labor, and overhead costs, no matter if they are variable or fixed, into the final cost of a product.

Q3: Note the expression: y = A/x<sup>3</sup>.Which statement

Q30: There are other ways of expressing uncertainty

Q40: A baseball player throws a ball straight

Q45: Inman Company has two fabric divisions, Cotton

Q46: The amount of fixed manufacturing overhead applied

Q46: Crickmore Industries has two divisions, the D

Q60: All of the following are categories of

Q68: What is (d)?<br>A) Less than 6 percent<br>B)

Q73: The annual after-tax operation costs would be<br>A)

Q85: Assume straight-line amortization in all computations, and