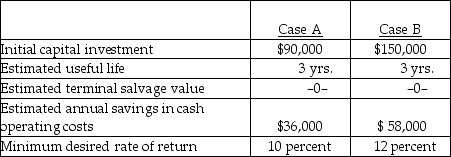

Below are two potential investment alternatives:

Assume straight-line amortization in all computations, and ignore income taxes.

Assume straight-line amortization in all computations, and ignore income taxes.

-The payback period in case B is

Definitions:

Effective Interest Rate Method

The method of amortizing discounts and premiums that provides for a constant rate of interest on the carrying amount of the bonds at the beginning of each period; often called simply the “interest method.”

Constant Dollar

A term used in economics to describe a monetary value that has been adjusted for inflation, thereby facilitating comparison of purchasing power over different periods.

Interest Expense

The cost incurred by an entity for borrowed funds, often reported on the income statement as a non-operating expense.

Unamortized Premium

The portion of the bond premium that has not yet been amortized (expensed) over the life of the bond.

Q21: A baseball thrown from the outfield is

Q31: The cash outflow for the purchase of

Q38: Which expression is dimensionally consistent with an

Q39: Two ropes are attached to a 50-kg

Q40: Capital expenditure models that identify criteria for

Q52: An object moves along the x axis,with

Q67: Vector 1 is 7 units long and

Q78: Producing forecasted financial statements for five- or

Q83: A management control system is a logical

Q102: Future cash flows expressed in present value