Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

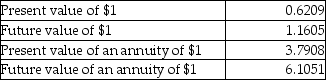

Time value factors are given below for 5 years and an interest rate of 10 percent.

-What is the net present value of the tax savings from depreciation?

Definitions:

Kilo-

A prefix in the metric system denoting a factor of one thousand.

Ounce

A unit of weight in the avoirdupois system, equal to 1/16 of a pound or approximately 28.35 grams.

Abbreviation

A shortened form of a word or phrase used to simplify written and verbal communication.

Pound

A unit of weight in the British imperial and the United States customary systems of measurement, equal to 16 ounces.

Q1: Vector <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6864/.jpg" alt="Vector Is

Q6: If we know an object is moving

Q16: The ratio T/m of the prefixes M

Q22: Which of the following statements about line

Q23: An object moves 10.0 m east in

Q31: The mass of a star is 8.0

Q34: Bit Electronics has supplied the following information

Q48: What is (a)?<br>A) $31,944<br>B) $30,328<br>C) $11,747<br>D) $12,882

Q57: Budgeting forces managers to think ahead and

Q75: Flexible-budget variances are designed to measure<br>A) effectiveness