Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

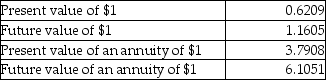

Time value factors are given below for 5 years and an interest rate of 10 percent.

-What is the total net present value of the investment?

Definitions:

Delusions of Grandeur

False beliefs about one's own importance, power, or talents, often occurring in psychiatric conditions like schizophrenia.

Bipolar Disorder

A disorder in which the mood alternates between two extreme poles (elation and depression); also referred to as manic depression.

Mood Disorders

A category of mental health disorders characterized by persistent changes in mood, encompassing major depression and bipolar disorder.

Depressed

A mood disorder marked by persistent feelings of sadness, hopelessness, and a lack of interest or pleasure in activities.

Q12: In the case of constant acceleration,the average

Q18: Barrell Company, a producer of computer disks,

Q19: According to agency theory, employment contracts will

Q29: Starting from rest,a car accelerates down a

Q33: What is the maximum transfer price that

Q35: Given the following information for Baugh Company:

Q37: If invested capital is defined as total

Q49: The master budget quantifies targets for all

Q72: _ means reporting and interpreting information that

Q80: A trapeze artist,with swing,weighs 800 N;he is