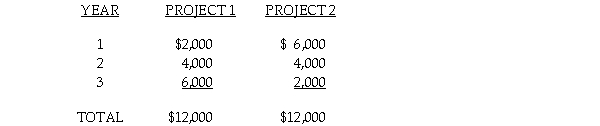

The Serena Company is evaluating two mutually exclusive projects with three-year lives. Each project requires an investment of $10,000. The projects have the following cash inflows received at the end of each year.  a. Determine the net present value of each project using an 8% discount rate.

a. Determine the net present value of each project using an 8% discount rate.

b. What can you conclude about the effect the timing of the cash flows has upon a project's net present value?

Definitions:

Cultural Variations

Differences in the practices, traditions, and norms observed among various cultures.

Independent

The state or condition of being free from outside control or influence, capable of thinking or acting for oneself.

Interdependent

this describes a relationship among entities where they are reliant on each other, such that the actions of one affect or are affected by the actions of the other.

Relational Focus

The emphasis on building and maintaining positive relationships within a team or organization as a key component of success.

Q16: A hockey puck moving at 7.00 m/s

Q22: Productivity is a measure of inputs divided

Q25: When an object is dropped from a

Q28: What is the capital turnover?<br>A) 3.2000<br>B) 0.1000<br>C)

Q34: The application of quality principles to all

Q34: Modern electroplaters can cover a surface area

Q52: Goal congruence exists when<br>A) managers are looking

Q72: The result of decisions to create conditions

Q72: Uncontrollable costs<br>A) are influenced by a manager's

Q80: A Hooke's law spring is compressed 14.6