Cedric Inc. is considering two mutually exclusive projects.

Project 1 requires an investment of $100,000 while project 2 requires an investment o $110,000.

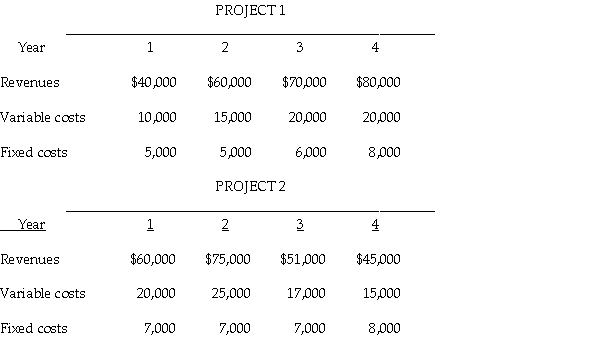

Revenues and costs for each project are shown below.  The company estimates that at the end of the fourth year Project 1 would have a salvage value of $20,000 and Project 2 would have a salvage value of $10,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of $20,000 and Project 2 would have a salvage value of $10,000.

Determine the net present value of each project using a 14% discount rate.

Definitions:

Reallocating Expenditures

The process of adjusting the distribution of spending across different areas or categories to better align with financial goals or constraints.

Budget Line

A budget line is a graphical representation of all possible combinations of two goods that can be purchased with a given budget, given their prices.

Money Income

The total amount of money earned or received by an individual or household from various sources before deductions such as taxes.

Noncash Gift-Giving

The act of giving gifts that are not in the form of money or monetary value, often personal or symbolic.

Q6: What is the speed of the rock

Q6: When making capital-budgeting decisions, the effects of

Q23: The mature market stage in a product's

Q27: The total purchases budgeted for July should

Q30: The direct-material usage variance for October is<br>A)

Q33: Vector <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6864/.jpg" alt="Vector Is

Q34: With regard to flexible-budget variances, Caulkins Corporation

Q44: A jogger runs halfway around a circular

Q89: Which of the following statements about depreciation

Q93: The first step in preparing the master