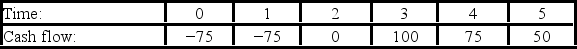

Compute the IRR statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent.

Definitions:

Truth Value

The attribute assigned to propositions to determine their veracity, quantified as either true or false, crucial in various branches of logic.

Conditional

A logical statement that connects two propositions, such that the second proposition follows from the first, typically formulated as "if... then..."

Equivalent Statements

Sentences that have the same truth value in every possible situation.

Biconditional

A logical statement wherein two propositions are true or false together; it is true if both parts have the same truth value.

Q2: A light-emitting diode has a power output

Q10: If the NASDAQ stock market bubble peaked

Q24: Which of these is an estimated WACC

Q26: The quantum mechanical model of the hydrogen

Q54: Happy Feet would like to maintain their

Q59: The standard deviation of the past five

Q77: The isotope <sup>64</sup>Zn has a nuclear radius

Q112: Suppose that T-shirts,Inc.'s capital structure features 25

Q117: An average of which of the following

Q136: KJ Enterprises estimates that it takes,on average,three