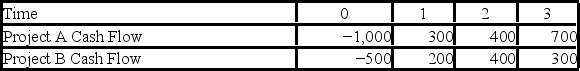

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.  Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Capital Account

An account used to track the investments made into a company by its owners, plus the retained earnings of the business.

Withdrawal Account

An account used in partnership accounting to record the amounts drawn out of the business by the partners for personal use.

Relative Ease

The level of simplicity or difficulty with which a task can be completed when compared to other tasks.

Formation

The process of legally creating a company or other organization; involves registration with relevant authorities and may include drafting a constitution or by-laws.

Q5: You are evaluating a project for your

Q12: In an x-ray diffraction experiment,using x-rays of

Q25: When looking at which of these types

Q32: For most businesses,particularly smaller ones,the most common

Q35: Assume that (i)the energy released per fission

Q64: The _ approach to computing a divisional

Q83: TJ Industries has 7 million shares of

Q86: If a firm has a cash cycle

Q104: Compute the discounted payback statistic for Project

Q119: All of the following are examples of