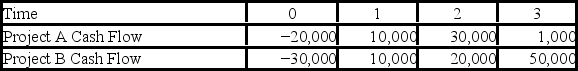

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Q9: Which of the following is a situation

Q17: A company's current stock price is $65.40

Q20: The following reaction can occur by the

Q41: FarCry Industries,a maker of telecommunications equipment,has 26

Q41: Which of the following best describes the

Q55: What is the wavelength of the line

Q65: ABC Inc.has a dividend yield equal to

Q69: Which of these statements is true?<br>A) When

Q71: Apple's 9 percent annual coupon bond has

Q71: Suppose you sell a fixed asset for