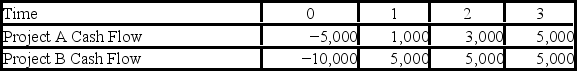

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Precise Definition

An exact and detailed explanation of a term or concept.

U.S. Residents

Individuals who reside in the United States, including citizens, permanent residents, and temporary occupants.

Serious Types

Refers to individuals or categories of behavior that are considered highly problematic, dangerous, or criminal in nature.

Deviant Behavior

Actions or behaviors that violate societal norms or expectations, which can be criminal or noncriminal in nature.

Q14: When the firm finances the seasonally adjusted

Q32: Which of these is similar to the

Q37: How many neutrons are in <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6864/.jpg"

Q40: Which of these are fees paid by

Q51: The exchange of mediating photons can produce<br>A)neither

Q55: What is the wavelength of the line

Q62: If an x-ray machine were designed to

Q78: Which of the following is a capital

Q83: Which of the following is NOT a

Q84: Which of the following current asset financing