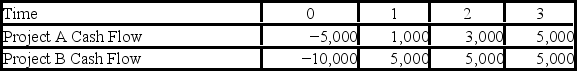

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Political Consequences

Political consequences are the outcomes that result from political actions or decisions, which can affect the governance, policies, and social structure of a society or organization.

Leader

An individual who guides or directs a group towards achieving specific goals or objectives.

Walking The Talk

Demonstrating integrity by aligning actions with spoken words and commitments.

Trustworthiness

The quality of being reliable, honest, and deserving of trust.

Q11: Why do firms offer customers discounts for

Q18: Your firm needs a machine which costs

Q19: Experimentally,strange particles can be produced in abundance,but

Q30: A company is considering two mutually exclusive

Q30: The energy released from a nuclear reaction

Q75: You are evaluating a project for The

Q82: Your firm needs a machine which costs

Q88: A company's current stock price is $84.50

Q108: Rings N Things Industries has 40 million

Q115: If a firm has a cash cycle