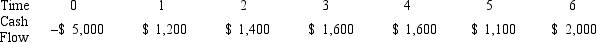

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Cash Savings

Funds that are put aside and are liquid, allowing for easy access in times of need.

Lower Labor

A reduction in the amount of labor used or required in a process or production.

Internal Rate

Often refers to the internal rate of return (IRR), which is the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

Operating Costs

Expenses associated with the day-to-day functioning of a business, such as rent, utilities, and payroll, excluding costs related to production.

Q4: The quantum mechanical model of the hydrogen

Q17: Suppose that TW,Inc.has a capital structure of

Q28: Suppose that Wave Runners' common shares sell

Q28: In an x-ray machine,electrons are accelerated and

Q33: Compute the standard deviation of the expected

Q35: Compute the standard deviation of Kohl's monthly

Q47: If the risk-free rate is 10 percent

Q61: Which rate-based decision statistic measures the excess

Q67: Determine which one of these three portfolios

Q78: B&O Cos.has sales of $850,000 and cost