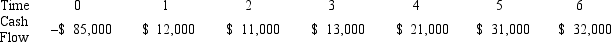

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Government Contracts

are agreements entered between companies and government entities for the provision of goods and services.

Qualifying Small Businesses

Refers to small businesses that meet specific criteria set by government or financial entities to be eligible for benefits or incentives.

Business Plan

A document that outlines a company's goals, the strategy to achieve them, financial forecasts, and market analysis.

Principal Owners

Individuals or entities that hold a primary share of ownership in a business, often having significant influence on company decisions.

Q3: Which of the following is the reward

Q3: The ground state configuration for an element

Q5: If the sum total mass of reactants

Q17: All of the following are strengths of

Q35: Compute the standard deviation of Kohl's monthly

Q38: If you invested $1,000 in Disney and

Q43: If a firm has a cash cycle

Q45: In contrast to Thomson's model of the

Q75: Which of the following is a technique

Q85: If you own 600 shares of Alaska