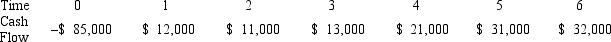

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the PI decision to evaluate this project; should it be accepted or rejected?

Definitions:

Money Growth

The increase in the amount of money in circulation within an economy, which can influence inflation and economic activity.

Aggregate-Demand Curve

A visual depiction illustrating the connection between the total economy's price level and the aggregate demand for products and services at this specific price point.

Interest-Rate Effect

The change in spending and borrowing behavior in an economy due to a change in interest rates, often influencing total demand.

U.S. Economy

The economic system of the United States, characterized by a mixed economy with both private enterprise and government regulation.

Q10: If the NASDAQ stock market bubble peaked

Q26: FlavR Co.stock has a beta of 2.0,the

Q35: When calculating operating cash flow for a

Q48: If the lifetime of a particle is

Q56: The ionization energy of the hydrogen atom

Q67: Which of the following is NOT a

Q76: Light with wavelength 5.6 * 10<sup>-7</sup> is

Q79: About what fraction of the initial activity

Q85: Which of these particles has the most

Q87: Which of the following is a money-market