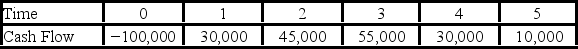

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the PI decision rule to evaluate this project; should it be accepted or rejected?

Use the PI decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Refund Risk

The risk that a debt issuer will repay borrowed funds before the maturity date, typically in a declining interest rate environment.

Working Capital Policy

A strategic approach to managing a company's short-term assets and liabilities to ensure it has sufficient liquidity to meet its short-term obligations.

Temporary Financing

Short-term loans or credit facilities intended to provide immediate liquidity or cover a short-term funding gap until long-term financing can be arranged.

Short-Term Assets

Assets expected to be converted into cash, sold, or consumed within one year or the operating cycle, whichever is longer.

Q15: The original nucleus and the final nucleus

Q17: You have been asked by the president

Q17: The Bohr theory does not predict that<br>A)hydrogen

Q18: Compute the expected return given these three

Q42: All of the following will result in

Q78: You own $10,000 of Denny's Corp.stock that

Q78: Rx Corp.stock was $60.00 per share at

Q81: Compute the standard deviation of the expected

Q88: A company's current stock price is $84.50

Q114: Which of the following is the technique