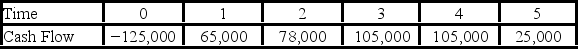

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.  Use the payback decision rule to evaluate this project; should it be accepted or rejected?

Use the payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Compounded Annually

Interest calculation method where the interest is added to the principal sum once a year, so each year’s interest earnings are based on the principal plus the accumulated interest.

RRSP Contributions

Money placed into a Registered Retirement Savings Plan, intended to serve as retirement savings and provide tax benefits in Canada.

First Contribution

The initial investment or deposit made into a financial instrument or savings account.

Compounded Monthly

The process of calculating interest on an investment monthly and adding it to the principal, resulting in interest earned on the previous interest.

Q12: If a firm has a cash cycle

Q13: Suppose your firm is considering two mutually

Q23: The Heisenberg uncertainty principle places restriction on

Q33: Which of the following is defined as

Q52: Which of the following is incorrect?<br>A) Most

Q57: Suppose that Model Nails,Inc.'s capital structure features

Q57: Compute the expected return and standard deviation

Q59: Compute the NPV for Project X with

Q91: What is the maximum velocity of a

Q110: The standard deviation of the past five