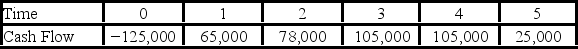

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.  Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Kilocalorie (Kcal) Intake

A measure of the total amount of energy consumed through food and drink, commonly referred to as calories, crucial for dietary planning and balance.

Referenced Daily Intakes (RDIs)

A set of dietary references used to establish the nutritional intake levels of various vitamins and minerals needed for healthy living.

Recommended Daily Allowances (RDAs)

Nutritional intake levels considered sufficient to meet the health needs of nearly all healthy individuals in a population.

Daily Values

Recommended daily nutrient intake levels established to inform consumers about nutrient content in food.

Q3: The ground state configuration for an element

Q3: Choosing the optimal level of investment in

Q24: Which of the following is a technique

Q29: Your firm needs a machine which costs

Q32: The experiment,which gave the first evidence for

Q32: Your company is considering a new project

Q67: A hydrogen atom in the ground state

Q68: Which of the following is the use

Q79: About what fraction of the initial activity

Q111: Reese's Resources faces a smooth annual demand