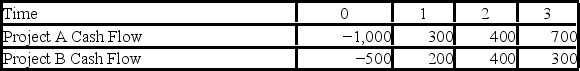

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.  Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Inflation Rates

The rate at which the general level of prices for goods and services is rising, indicating the purchasing power of currency is falling.

Mean Absolute Deviation

A statistical measure of the average absolute deviations from a dataset's mean, indicating variability within the data.

Actual Sales

The real or recorded number of sales transactions completed within a given period.

Forecasts

Predictions about future conditions or occurrences, often based on analysis of trends and data.

Q5: You are evaluating a project for your

Q6: Which of the following demonstrated the relation

Q6: Light of wavelength 439 nm is incident

Q34: Which of the following will directly impact

Q43: If the radius of the electron orbit

Q54: Bragg reflection results in a first-order maximum

Q70: Cup Cake Ltd.has 20 million shares of

Q96: A company has a beta of 4.5.If

Q106: If a firm has a cash cycle

Q113: Suppose that Mack Industries has annual sales