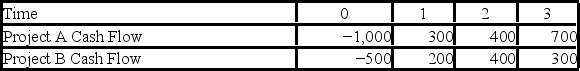

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.  Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Convertible Bonds

Debt securities that offer the holder the right to exchange them for a fixed number of shares of the issuing company, usually at a specified time.

Naked Put

An options strategy where the investor sells put options without holding the underlying security, exposing them to potentially unlimited losses.

Expected Dollar Profit

The forecasted amount of money that an investment is likely to earn in dollars.

Major Drop

A significant decline in the price or value of an asset or stock within a short period of time.

Q10: JaiLai Cos.stock has a beta of 1.7,the

Q17: The past five monthly returns for Kohl's

Q22: Shares of stock issued to employees that

Q25: A capture by a target nucleus of

Q29: Which of the following will directly impact

Q31: In the reaction <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6864/.jpg" alt="In the

Q40: The Lyman series of hydrogen is made

Q62: The size and sign of the charge

Q67: Calculate the range of the force that

Q84: Which of the following current asset financing