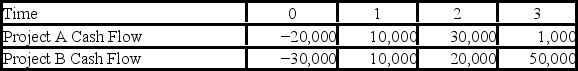

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Randomized Block Design

A statistical experiment design that aims to reduce the effects of variability among experimental units by grouping them into blocks.

SSB

In the context of ANOVA, SSB refers to the Sum of Squares Between groups, which helps in assessing the variability between different groups.

Fixed-Effects ANOVA

A statistical method used to analyze the differences among group means in a sample where the groups are defined by some fixed factor.

Random-Effects ANOVA

A statistical method that accounts for variability within and across groups when analyzing differences among multiple groups.

Q13: The annual return on the S&P 500

Q18: In the four radioactive series,the nuclei decay

Q28: Suppose that Wave Runners' common shares sell

Q45: ADK has 30,000 15-year 9 percent annual

Q55: Which of the following is NOT an

Q71: A company has a beta of 0.50.If

Q75: What is meant by a particle being

Q77: Operating cycle is measured as:<br>A) inventory turns

Q83: In order to be useful in sustaining

Q90: The weak force is mediated by<br>A)the W<sup>+</sup>