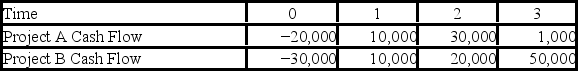

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Nucleus

A membrane-bound organelle within a eukaryotic cell that contains most of the cell's genetic material.

Cytosol

The liquid found inside cells, excluding organelles and other structures, in which cellular components are suspended.

Expressed Genetic Traits

Observable characteristics or phenotypes of an organism that result from the interaction of its genetic makeup with the environment.

Genotype

Particular genetic makeup of an individual.

Q35: To what is the radiation damage in

Q43: If a firm has a cash cycle

Q56: Section 179 allows a business,with certain restrictions,to

Q64: The _ approach to computing a divisional

Q66: OMG Inc.has 4 million shares of common

Q68: Your company is considering a project that

Q73: Which of these is the investor's combination

Q76: Would it be worth it to incur

Q80: Suppose your firm is seeking a five-year,amortizing

Q81: The Dirac theory predicted that a positron