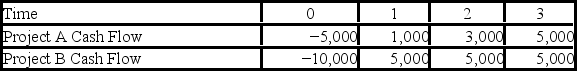

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the MIRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Index Funds

Investment funds that replicate the performance of a specific index by holding all or a representative sample of the securities in the index.

PHStat

An Excel add-in that enhances the statistical capabilities of Microsoft Excel, allowing for more advanced data analysis.

Full-fare Air Ticket

A Full-fare Air Ticket is the purchase price for an airline seat without any discounts or promotions, usually offering maximum flexibility in terms of changes and cancellations.

Decision Tree

A graphical representation of possible solutions to a decision based on certain conditions or probabilities.

Q13: The annual return on the S&P 500

Q42: You own $9,000 of Olympic Steel stock

Q59: Which of the following resemble checks,but differ

Q68: Year to date,Company Y had earned a

Q69: When considering the law of conservation of

Q73: If the stable nuclei are plotted with

Q74: A production strategy that attempts to improve

Q85: The area of management concerned with designing

Q101: Which of the following is a technique

Q103: IBM's stock price is $22,it is expected