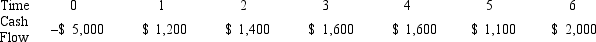

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Break-Even Point

The point at which total costs match total revenue, meaning there is neither profit nor loss.

Sales Differential

Sales differential is the difference in sales volume between a company’s actual sales and a predetermined benchmark, such as past sales performance or market expectations.

Core Value

Fundamental beliefs or principles that guide an organization's actions and decision-making.

IBM

International Business Machines Corporation, a global technology company known for its computer hardware, software, and IT services.

Q18: Compute the expected return given these three

Q32: Which of these is similar to the

Q33: Which of the following is defined as

Q34: Effects that arise from a new product

Q57: If a photon produces an electron-positron pair

Q60: Suppose your firm is considering two independent

Q62: Everything else held constant,will an increase in

Q67: Suppose that Freddy's Fries has annual sales

Q74: How many possible IRRs could you find

Q108: The financing policy that will result in