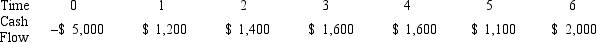

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Normally Distributed

Describes a bell-shaped curve distribution where most observations cluster around the central peak and the probabilities for values further away from the mean taper off equally in both directions.

Explanatory Variable

A variable that is manipulated or categorized to investigate its effect on a response variable in research.

Sample Correlation

A measure of the strength and direction of a linear relationship between two variables in a sample.

Obesity Prevalence

The proportion of a population that is classified as obese, typically defined by a Body Mass Index (BMI) of 30 or higher.

Q22: A local bank is contemplating opening a

Q53: Jenna receives an investment newsletter that recommends

Q59: A pure sample of <sup>226</sup>Ra contains 1.5

Q64: You have a portfolio with a beta

Q68: Which of the following is the use

Q79: Suppose your firm is seeking a 7-year,amortizing

Q86: Suppose you sell a fixed asset for

Q92: A financial asset will pay you $50,000

Q100: Esteé Lauder's upcoming dividend is expected to

Q112: Suppose that T-shirts,Inc.'s capital structure features 25