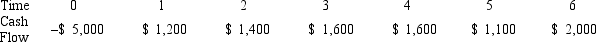

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

1900

A year that marks the beginning of the 20th century, noted for various historical, cultural, and technological developments around the world.

Racial Conventions

Socially constructed beliefs, practices, and norms that define and differentiate races, often leading to discrimination and societal inequalities.

Jack Johnson

Jack Johnson was the first African American world heavyweight boxing champion, renowned for his groundbreaking career and the racial prejudices he fought against during the early 20th century.

Racial Decorum

The expected or prescribed manners and behaviors regarding race and inter-racial interactions, often within a specific cultural or societal context.

Q11: Consider the hydrogen atom,singly ionized helium atom,and

Q13: If an electron has a measured wavelength

Q15: Why do we use market-value weights instead

Q25: Which of the following statements is correct?<br>A)

Q69: What is the energy of the photons

Q73: If the stable nuclei are plotted with

Q74: Coke is planning on marketing a new

Q76: Your company is considering a new project

Q83: You own $14,000 of Diner's Corp.stock that

Q135: Happy Feet would like to maintain their