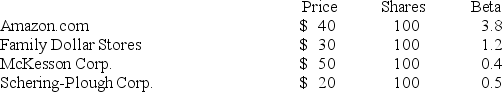

You hold the positions in the following table.What is the beta of your portfolio? If you expect the market to earn 12 percent and the risk-free rate is 3.5 percent,what is the required return of the portfolio?

Definitions:

Market Portfolio

A theoretical portfolio that includes all assets available in the market, each weighted by its market capitalization, often used in the Capital Asset Pricing Model (CAPM).

SML Relationship

The Security Market Line relationship, which represents the expected return of a security or portfolio in relation to its beta, or market risk.

Multifactor CAPM

An extension of the Capital Asset Pricing Model (CAPM) that incorporates multiple factors in the assessment of risk and expected return of an asset, beyond just the market risk.

Hedge Portfolios

Investment strategies designed to reduce or mitigate risk in an investment portfolio by making counterbalancing investments, often involving derivatives.

Q25: When looking at which of these types

Q26: A company has a beta of 3.25.If

Q28: The Wall Street Journal states that the

Q38: If you invested $1,000 in Disney and

Q42: Paper Exchange has 10 million shares of

Q56: Section 179 allows a business,with certain restrictions,to

Q78: Which of the following makes this a

Q85: Sports Corp.has 10 million shares of common

Q89: Compute the NPV statistic for Project X

Q103: Value stocks usually have:<br>A) low P/E ratios