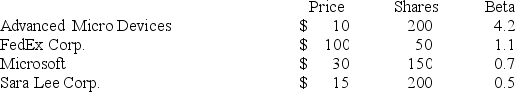

You hold the positions in the following table.What is the beta of your portfolio? If you expect the market to earn 10 percent and the risk-free rate is 4 percent,what is the required return of the portfolio?

Definitions:

Fair Value

The estimated price at which an asset could be bought or sold in a current transaction between willing parties, other than in a liquidation sale.

Property Plant

Property, plant, and equipment (PP&E) are tangible fixed assets used in the production or supply of goods and services, minus accumulated depreciation.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by an independent organization, providing a global framework for how public companies prepare and disclose their financial statements.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board that is globally accepted for preparing financial statements.

Q4: The optimal cash replenishment level will decrease

Q5: Which of the following is a true

Q24: Consider the characteristics of the following three

Q45: Primary market financial instruments include stock issues

Q56: All of the following capital budgeting tools

Q73: Suppose you sell a fixed asset for

Q74: Coke is planning on marketing a new

Q89: Suppose that Tan Lotion's common shares sell

Q94: Suppose your firm has decided to use

Q125: JLP Industries has 6.5 million shares of