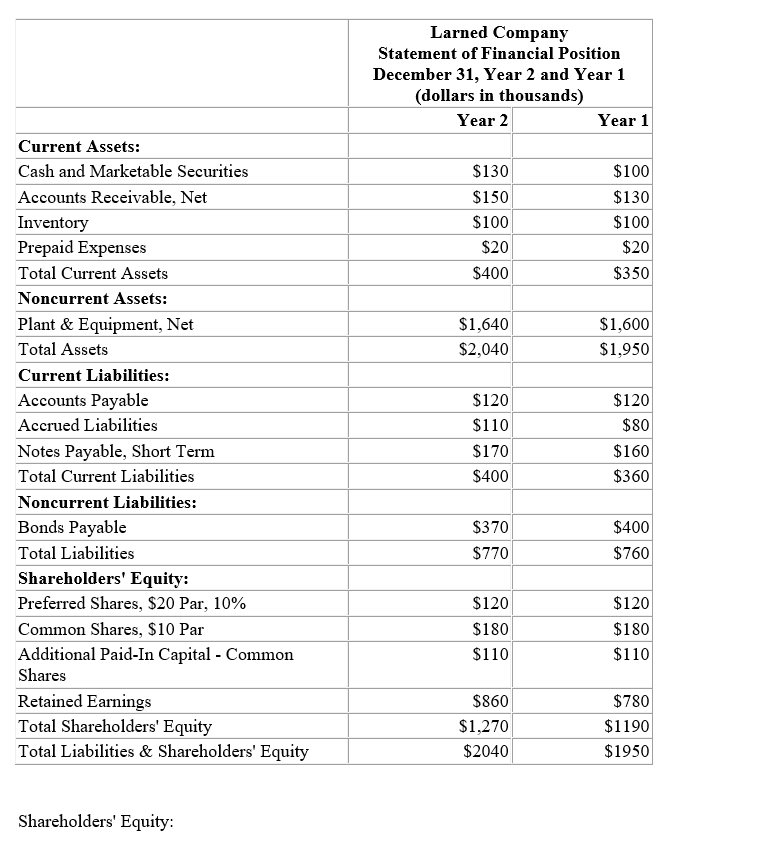

Financial statements for Larned Company appear below:

Shareholders' Equity:

Total dividends during Year 2 were , of which were for preferred shares. The market price of a common share on December 31, Year 2 was .

-Larned Company's price-earnings ratio on December 31,Year 2 was closest to which of the following?

Definitions:

Notes Receivable

Notes receivable are written promises for payments to be received, including principal and possibly interest, recognized as assets on a company's balance sheet.

Promissory Note

A financial instrument that contains a written promise to pay a specified sum of money to another party at a determined future date or on demand.

Interest Revenue

Income earned from investments, such as savings accounts, bonds, or loans, calculated as a percentage of the principal sum.

Maturity Date

The specified date on which the principal amount of a financial instrument, such as a bond or loan, becomes due and payable.

Q5: You borrow $10,000 and will pay back

Q38: March Company's average sale period (turnover in

Q45: Oasis Products,Inc.has current liabilities = $10 million,current

Q47: Last year Mocha Java,Inc.had an ROA of

Q63: What annual rate of return is earned

Q70: Ramakrishnan Inc.reported 2018 net income of $20

Q118: Assume the company has 50 units left

Q118: A firm has a profit margin of

Q119: Trend percentages state several years' financial data

Q168: Financial statements for Raridan Company appear