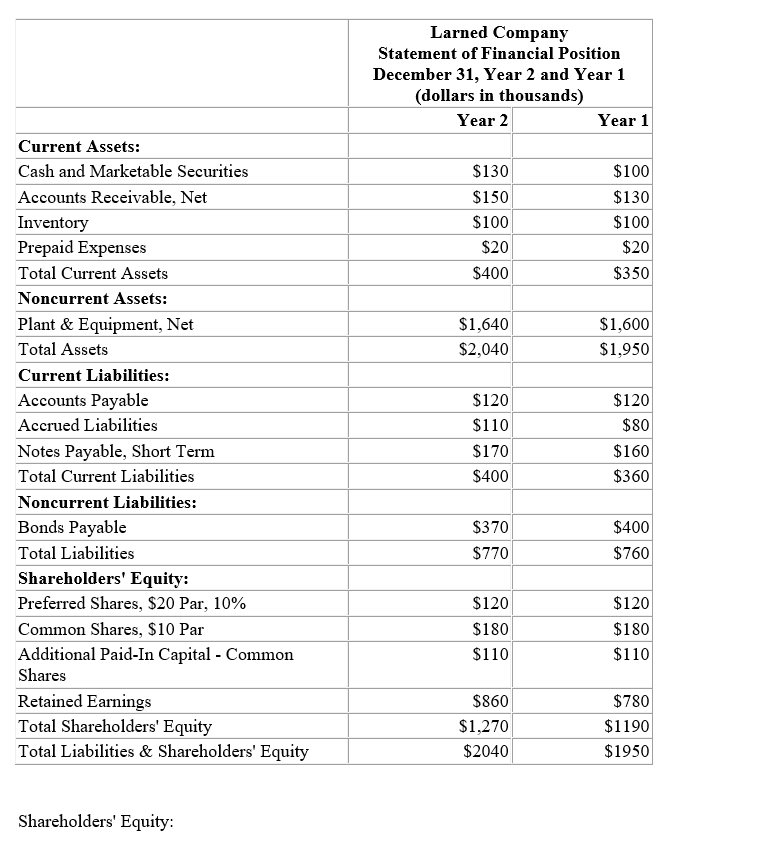

Financial statements for Larned Company appear below:

Shareholders' Equity:

Total dividends during Year 2 were , of which were for preferred shares. The market price of a common share on December 31, Year 2 was .

-Larned Company's dividend payout ratio for Year 2 was closest to which of the following?

Definitions:

Management Freedom

The extent to which managers have the autonomy to make decisions, innovate, and guide their teams without excessive constraints.

Benefits

Advantages or payments provided to employees in addition to their regular salaries, such as health insurance, pension plans, and paid vacation.

Costs

The amounts of money required for the production of goods or services, or the operation of a company or organization.

Formulate HR Policy

The process of developing guidelines and regulations for managing an organization’s human resources.

Q15: During April,Division D of Carney Company had

Q25: Reed's Birdie Shot,Inc.'s 2018 income statement lists

Q27: WP Company produces products X,Y,and Z

Q35: Given the following data:<br> <span class="ql-formula"

Q41: A deposit of $500 earns 5 percent

Q59: Harker Company,a retailer,had cost of goods sold

Q70: If Varone has an opportunity to sell

Q96: Common stockholders' calculating equity divided by number

Q152: Which of the following is a correct

Q166: How is horizontalanalysis of financial statements accomplished?<br>A)