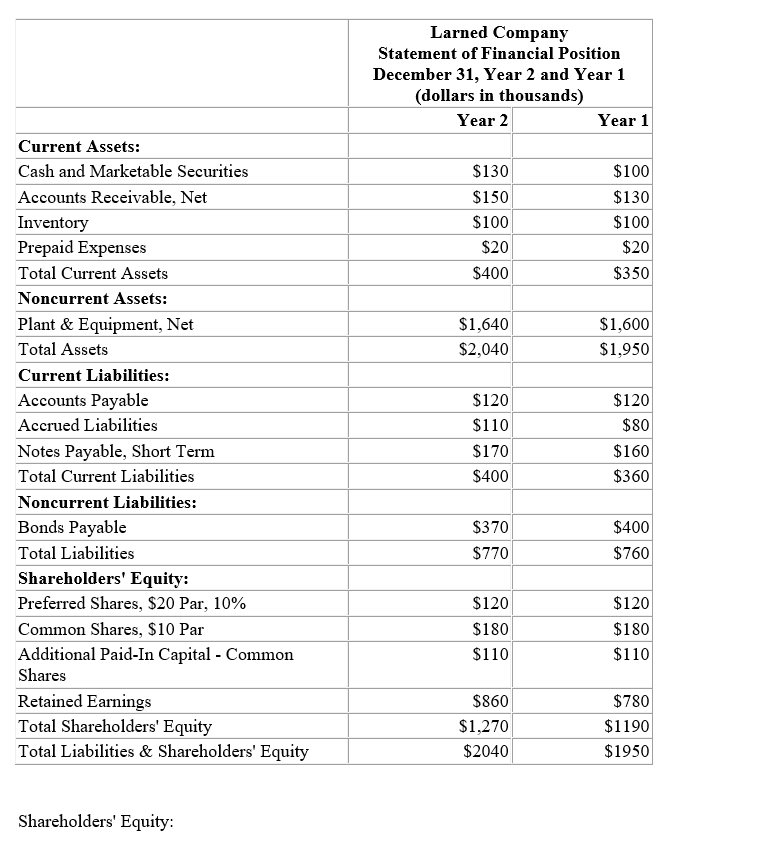

Financial statements for Larned Company appear below:

Shareholders' Equity:

Total dividends during Year 2 were , of which were for preferred shares. The market price of a common share on December 31, Year 2 was .

-Larned Company's book value per share at the end of Year 2 was closest to which of the following?

Definitions:

Personal Gains

Benefits or advantages gained by an individual, often from a situation or through their actions, which can be material or immaterial.

Encouraging Behavior

Actions intended to support, motivate, or promote confidence in individuals or groups.

Challenger

An entity or individual that questions, competes against, or provides alternatives to the current status quo or dominant players.

Devil's Advocate

A person who expresses a contentious opinion in order to provoke debate or test the strength of opposing arguments.

Q19: These individuals examine the firm's accounting systems

Q37: The increase in oil production in the

Q38: Which of the following would be

Q49: Crispy Corporation has net cash flow from

Q67: Assume you borrow $500 from a payday

Q68: All of the following are cash flows

Q78: Earnings per common share will immediately increase

Q108: You want to retire in 25 years

Q115: You are thinking of investing in Tikki's

Q124: Larned Company's earnings per common share for