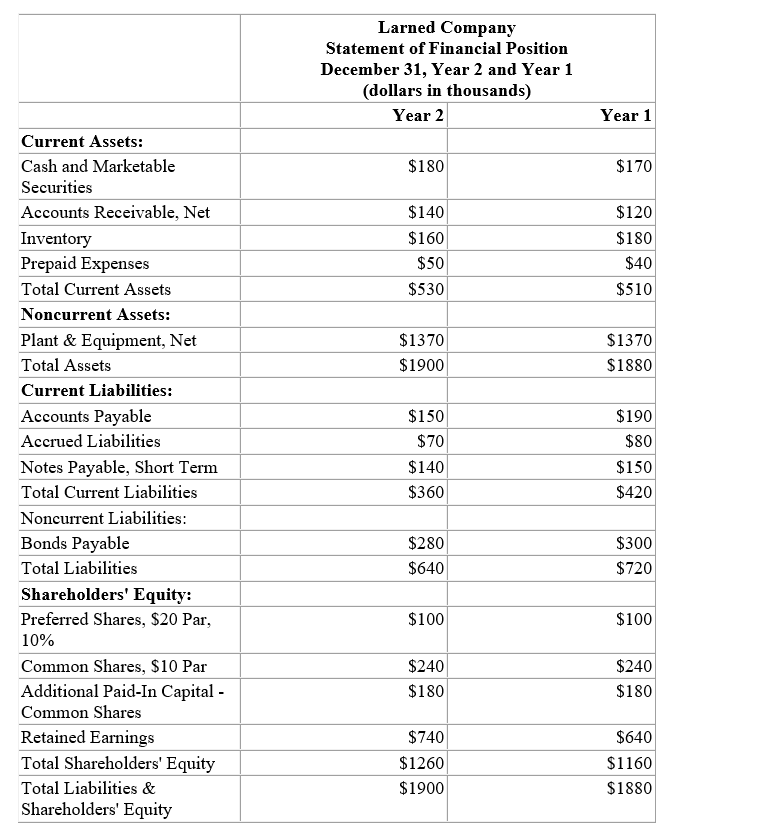

Financial statements for Laroche Company appear below:

Shareholders' Equity:

Total dividends during Year 2 were , of which were preferred dividends. The market price of a common share on December 31, Year 2 was .

-Laroche Company's return on common shareholders' equity for Year 2 was closest to which of the following?

Definitions:

Secured Interest

An interest in personal property or fixtures that secures payment or performance to a creditor.

Personal Property

Tangible, movable objects.

Uniform Commercial Code

A comprehensive set of laws governing all commercial transactions in the United States.

Perfection

The series of legal steps a secured party takes to protect its right in the collateral from the other creditors who want their debt returned through the same collateral.

Q24: What is the value in year 6

Q32: Laroche Company's dividend payout ratio for Year

Q80: Dresser Company uses time and material

Q84: A firm has sales of $690,EBIT of

Q92: Which statement is true?<br>A) The less liquid

Q96: Harris Company,a retailer,had cost of goods sold

Q107: How many minutes of grinding machine time

Q123: Scenario A: At age 27,you invest $1,500

Q130: Assume that Tolar decides to upgrade the

Q177: Which of the following is the numerator