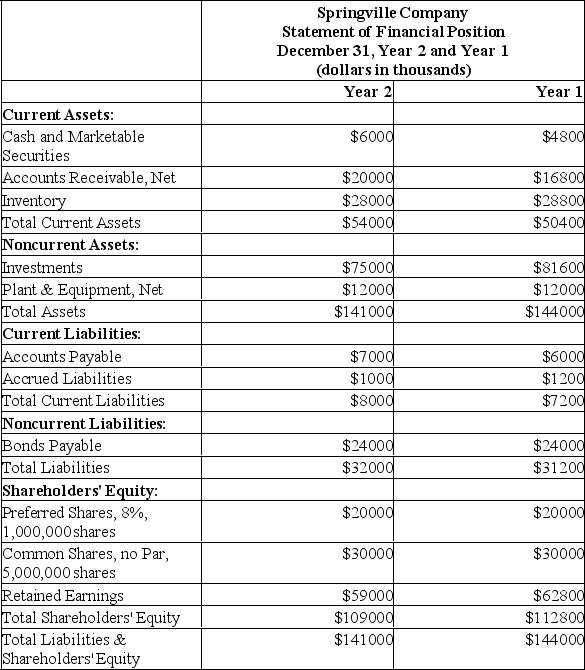

Comparative financial statements for Springville Company for the last two years appear below.The market price of Springville's common shares was $25 per share on December 31,Year 2.During Year 2,dividends of $2,000,000 were paid to preferred shareholders and $10,000,000 to common shareholders.

Required:

Calculate the following for Year 2:

a)Dividend payout ratio.

b)Dividend yield ratio.

c)Price-earnings ratio.

d)Accounts receivable turnover.

e)Inventory turnover.

f)Return on total assets.

g)Return on common shareholders' equity.

h)Was financial leverage positive or negative for the year? Explain.

Definitions:

Standard Quantity Allowed

The predetermined amount of materials or inputs expected to be used in the production of goods or services under normal conditions.

Total Sales Variance

The difference between a company's actual sales and its budgeted or projected sales, indicating performance deviations.

Average Price

The mean price of a product or stock over a specific period, calculated by dividing the total cost by the number of units.

Direct Materials Price Variance

The difference between the actual cost and standard cost of materials used in production, highlighting efficiency in procurement.

Q20: According to the list provided in the

Q63: From the perspective of control,the best form

Q69: The net present value of this

Q71: For the past year,Largo Company recorded sales

Q72: The markup over cost under the

Q102: Juanita earns $68,000 annually as a

Q125: The 2018 income statement for Lou's Shoes

Q128: Orantes Company's average sale period (turnover in

Q135: Assume that the company uses the

Q201: What were the sales for Year 2?<br>A)