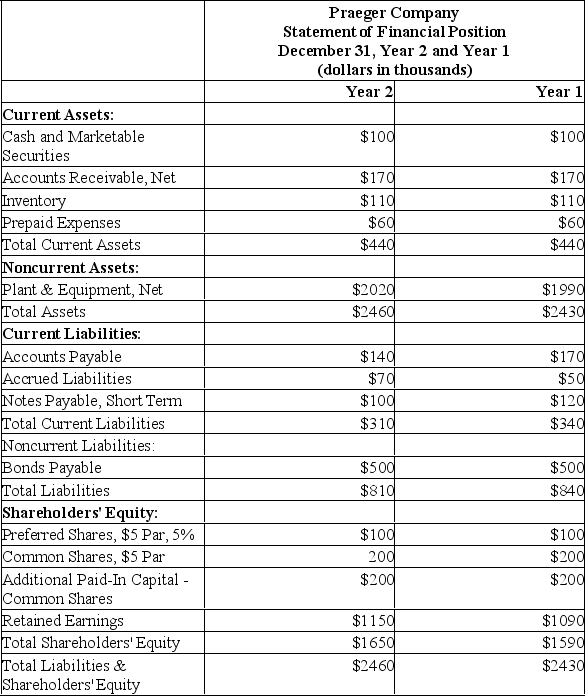

Financial Statements for Praeger Company Appear Below Dividends During Year 2 Totalled $45,000,of Which $10,000 Were Preferred

Financial statements for Praeger Company appear below:

Dividends during Year 2 totalled $45,000,of which $10,000 were preferred dividends.The market price of a common share on December 31,Year 2 was $30.

The preferred shares are convertible to common shares on the basis of 2 common shares for each preferred share.

Required:

Calculate the following for Year 2:

a)Basic earnings per common share.

b)Fully diluted earnings per common share.

c)Price-earnings ratio (use basic earnings per share).

d)Dividend payout ratio (use basic earnings per share).

e)Dividend yield ratio.

f)Return on total assets.

g)Return on common shareholders' equity.

h)Book value per share.

i)Working capital.

j)Current ratio.

k)Acid-test (quick)ratio.

l.)Accounts receivable turnover.

m)Average collection period (age of receivables).

n)Inventory turnover.

o)Average sale period (turnover in days).

p)Times interest earned.

q)Debt-to-equity ratio.

Definitions:

Visual Illusion

A misleading image or visual trick that perceives the brain into seeing something different from the actual reality.

Sensation

The process by which our sensory receptors and nervous system receive and represent stimulus energies from our environment.

Stimulus Attributes

Characteristics or features of a stimulus that can influence an individual's response or perception.

Lower-Order

Pertaining to basic or fundamental processes that do not involve complex cognitive operations.

Q24: The Sarbanes-Oxley Act requires public companies to

Q27: The following data are available for

Q80: On which of the four major financial

Q83: The following data pertain to

Q88: Magner,Inc.uses the absorption costing approach to

Q99: What were Division B's average operating assets

Q103: LLV Inc.originally forecasted the following financial data

Q113: The 2011 income statement for Duffy's Pest

Q135: A company anticipates a taxable cash

Q176: Larned Company's dividend payout ratio for Year