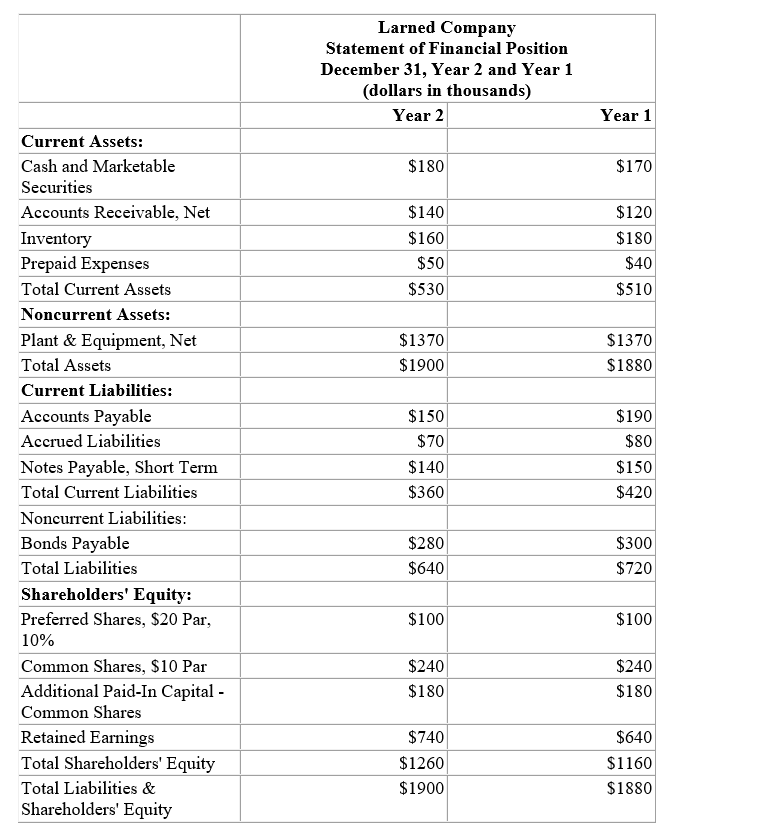

Financial statements for Laroche Company appear below:

Shareholders' Equity:

Total dividends during Year 2 were , of which were preferred dividends. The market price of a common share on December 31, Year 2 was .

-Laroche Company's dividend yield ratio on December 31,Year 2 was closest to which of the following?

Definitions:

CVP Graph

A visual representation of the Cost-Volume-Profit analysis that illustrates the relationships between costs, volume, and profit.

Total Fixed Expenses

Total fixed expenses refer to the sum of all costs that do not change with the level of production or sales over a certain period.

Total Variable Expenses

The sum of all costs that vary directly with the level of production or sales volume over a specific period.

Degree of Operating Leverage

A financial metric that measures the sensitivity of a company's operating income to its sales volume.

Q14: Which of the following is legal duty

Q34: Which of the following personal decision IS

Q56: Boa Corp.uses the direct method

Q79: If the new product is added next

Q81: Two or more different products that are

Q88: Ultra Inc.had $100 million in retained earnings

Q90: Which of the following would be

Q93: Lab R Doors' year-end price on its

Q111: You have located the following information on

Q179: Suppose a manager's performance is to be