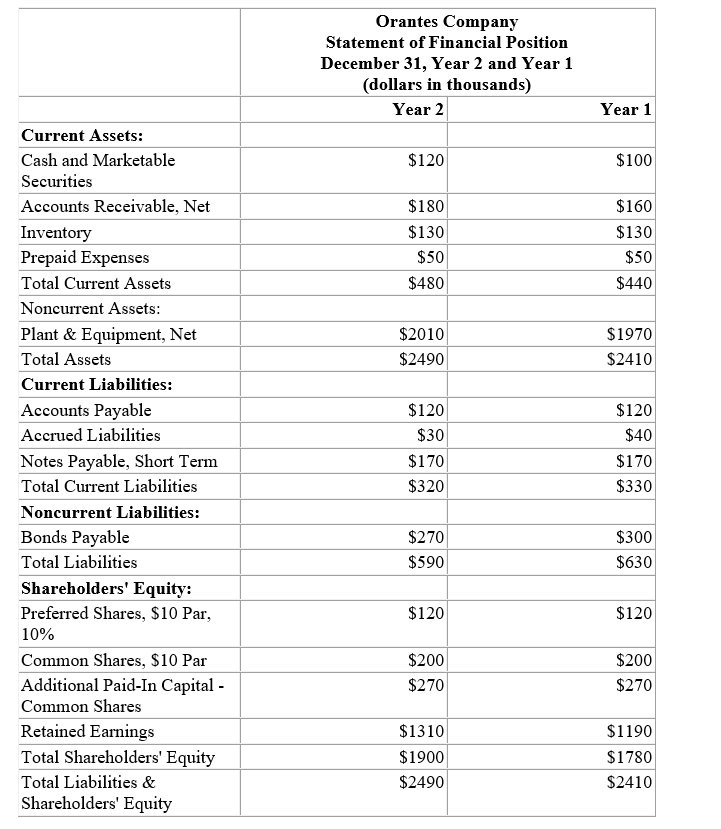

Financial statements for Orantes Company appear below:

Total dividends during Year 2 were , of which were preferred dividends. The market price of a common share on December 31, Year 2 was .

-Orantes Company's current ratio at the end of Year 2 was closest to which of the following?

Definitions:

Present Value

The current worth of a future sum of money or stream of cash flows given a specified rate of return.

Extraction Costs

The expenses associated with the process of removing raw materials from the earth for use in production or consumption.

Fishery Collapse

A rapid decline in a fishery’s population because its fish are being harvested faster than they can reproduce.

Harvesting Rates

The speed at which natural resources are extracted or harvested, impacting sustainability and future availability.

Q2: The time and material approach pricing

Q29: The board of directors<br>A) are hired by

Q49: Financial statements for Rarity Company appear

Q51: The Ohio Corporation had a 2018 taxable

Q59: Harker Company,a retailer,had cost of goods sold

Q61: Which financial statement shows the total revenues

Q69: Marcial Company's acid-test (quick)ratio at the end

Q72: The markup over cost under the

Q87: You have been given the following information

Q189: Consider the following three statements:<br>I.A profit centre