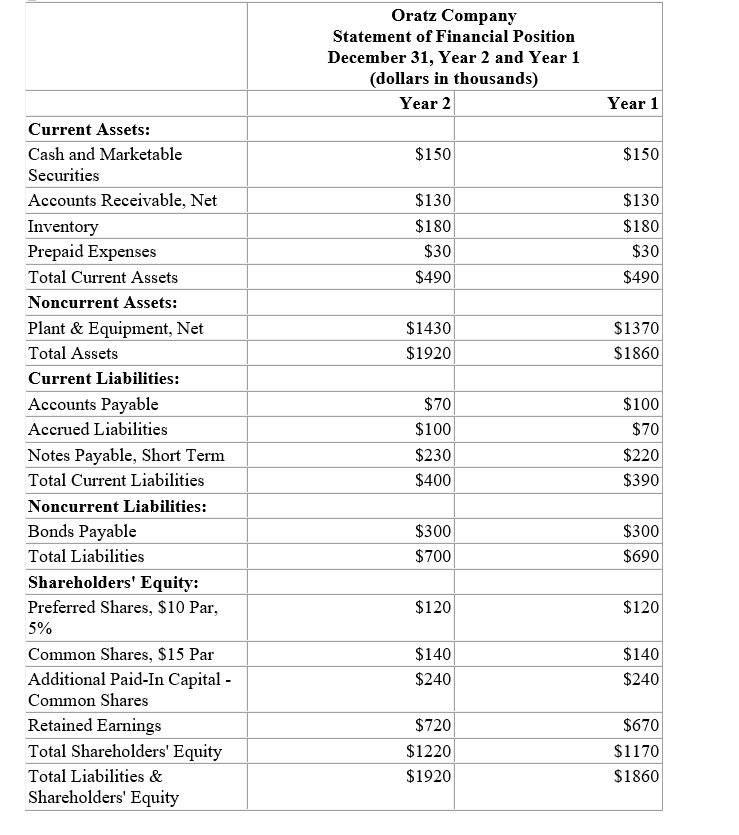

Financial statements for Oratz Company appear below:

Total dividends during Year 2 were , of which were preferred dividends. The market price of a common share on December 31, Year 2 was .

-Oratz Company's earnings per common share for Year 2 was closest to which of the following?Do not round intermediate calculations.

Definitions:

Authentic Leadership

A leadership style centered on authenticity, transparency, and trust, encouraging leaders to be genuine and true to their values.

Prescriptive

Pertaining to rules or guidelines that recommend or dictate specific behaviors or actions to achieve desired outcomes.

Directive

A leadership approach characterized by providing clear instructions, setting standards, and monitoring performance, often focusing on task achievement.

Descriptive

Characterizing the use of words or illustrations to convey the characteristics or details of something.

Q1: The Miller Company's current ratio is greater

Q17: A metaphor used to illustrate how an

Q19: If Austin chooses to produce 4,000 afghans

Q31: Which of the following refer to ratios

Q36: Use the following information to find dividends

Q39: Overland Company has gathered the

Q80: What is MK Company's return on common

Q114: Oratz Company's dividend yield ratio on December

Q141: When calculating the return on total assets,the

Q151: Oratz Company's times interest earned for Year