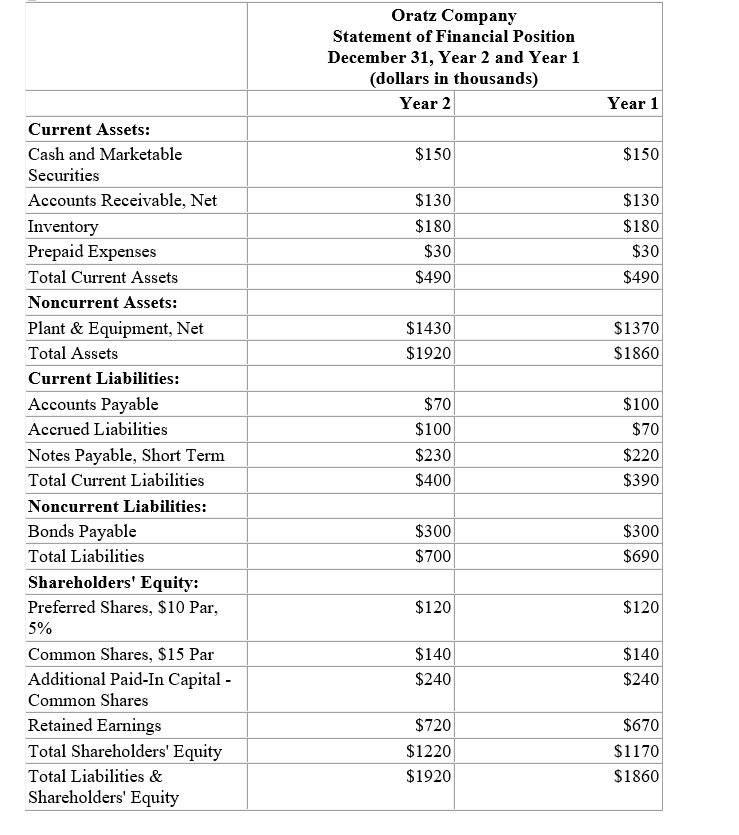

Financial statements for Oratz Company appear below:

Total dividends during Year 2 were , of which were preferred dividends. The market price of a common share on December 31, Year 2 was .

-Oratz Company's current ratio at the end of Year 2 was closest to which of the following?

Definitions:

Absolute Purchasing Power Parity

A theory that suggests that in the absence of trade barriers and transportation costs, identical goods will have the same price in different countries when prices are expressed in a common currency.

Covered Interest Arbitrage

A financial strategy to profit from the difference in interest rates between two countries while hedging against exchange rate risks.

Spot Rate

The current market price at which a particular asset, such as a currency, commodity, or security, can be bought or sold for immediate delivery.

Relative Purchasing Power Parity

Relative Purchasing Power Parity (RPPP) is an economic theory which postulates that the rate at which the exchange rate between two currencies will change over time is equivalent to the rate at which their purchasing power converges, essentially due to inflation rates differences.

Q5: Which ratio measures the operating return on

Q6: A company anticipates a tax-deductible cash

Q31: The overall goal of the financial manager

Q41: A company needs an increase in

Q44: The agency relationship in corporate finance occurs<br>A)

Q50: Which of the following refers to the

Q58: A firm's net income last year was

Q117: A firm has EBIT of $1,000,000 and

Q132: The market price of XYZ Company's common

Q194: Curry Company's average collectionperiod (age of receivables)for