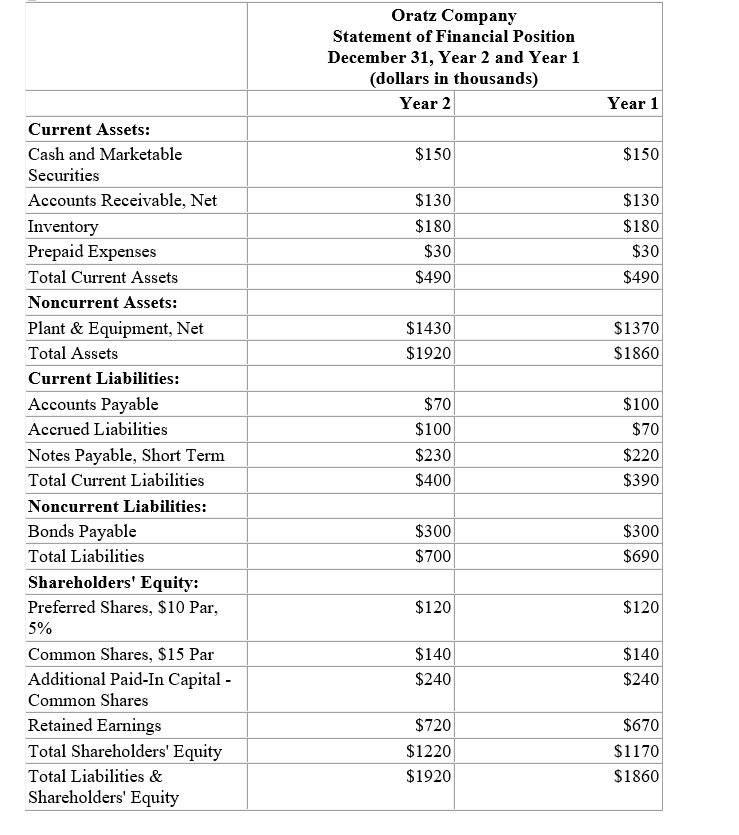

Financial statements for Oratz Company appear below:

Total dividends during Year 2 were , of which were preferred dividends. The market price of a common share on December 31, Year 2 was .

-Oratz Company's average sale period (turnover in days) for Year 2 was closest to which of the following?

Definitions:

Facility-Level Costs

Costs related to activities and services that support the entire organization, like factory rent or salaries of maintenance staff.

Facility-Level Costs

Fixed costs that do not vary with the level of production or output, associated with maintaining a production facility.

Activity-Based Costing

An accounting method that allocates costs to products or services based on the activities and resources consumed in the production or delivery process.

Overhead Assignment

The process of allocating indirect costs (or overheads) to various cost objects such as products, projects, or departments.

Q18: The internal rate of return of

Q32: A firm has sales of $10,000,EBIT of

Q42: Lab R Doors' year-end price on its

Q55: This type of business organization is relatively

Q61: The times interest earned ratio of McHugh

Q67: The net present value of the

Q77: Which of the following costs are always

Q82: Soccer Starz,Inc.started the year with a balance

Q111: What would be the immediate cash outflow

Q160: Which of the following would be